michigan sales tax exemption nonprofit

The following exemptions DO NOT require the purchaser to provide a number. Michigan Nonprofits and Sales Tax Exemptions.

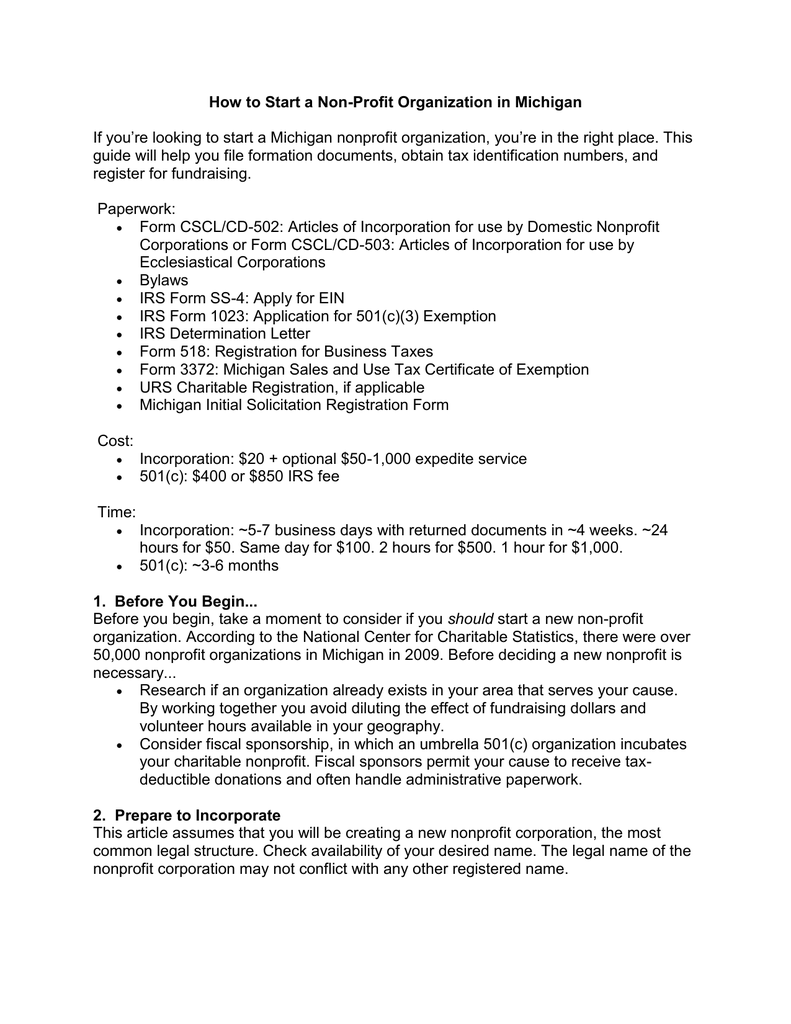

How To Start A Nonprofit Step By Step

Michigan 501c3 nonprofits are exempt from paying sales tax on purchases.

. Apply for exemption from state taxes. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. All claims are subject to audit.

There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors making a claim for exemption from sales or use tax. Effective March 28 2013 certain charitable organization in the state of Michigan will be eligible for a sales tax exemption on purchases of personal property worth 5000 or less. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury. N Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520. Sign and provide your title ie.

07 Retail 15 Non-Profit 501c3 or 501c4 08 Church 16 Other Print the name of the business address city state and zip code. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. To Obtain Michigan Sales and Use Tax Exemptions.

Once your organization receives your 501c determination letter from the IRS it will automatically be exempt from paying corporate income tax. Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits. 4q 1 A sale of tangible personal property not for resale to the following subject to subsection 5 is.

Certificate must be retained in the Sellers Records. When completing a sales tax exemption certificate a nonprofit should be certain to complete the form in full and avoid an simple mistakes that may delay processing. Church Govemment Entity Nonprofit School or Nonprofit Hospital Circle type of organization.

D Contractor must provide Michigan Sales and Use Tex Contractor Ellglbllity Stat11ment Form 3520. The followlng exemptions DO NOT require the purchaser to provide a number. Harbor Compliance can obtain Michigan sales tax exemption for your 501c3 nonprofit.

Sales Tax Exemptions in Michigan. Michigan Sales and Use Tax Certificate of Exemption INSTRUCTIONS. All claims are subject to audit.

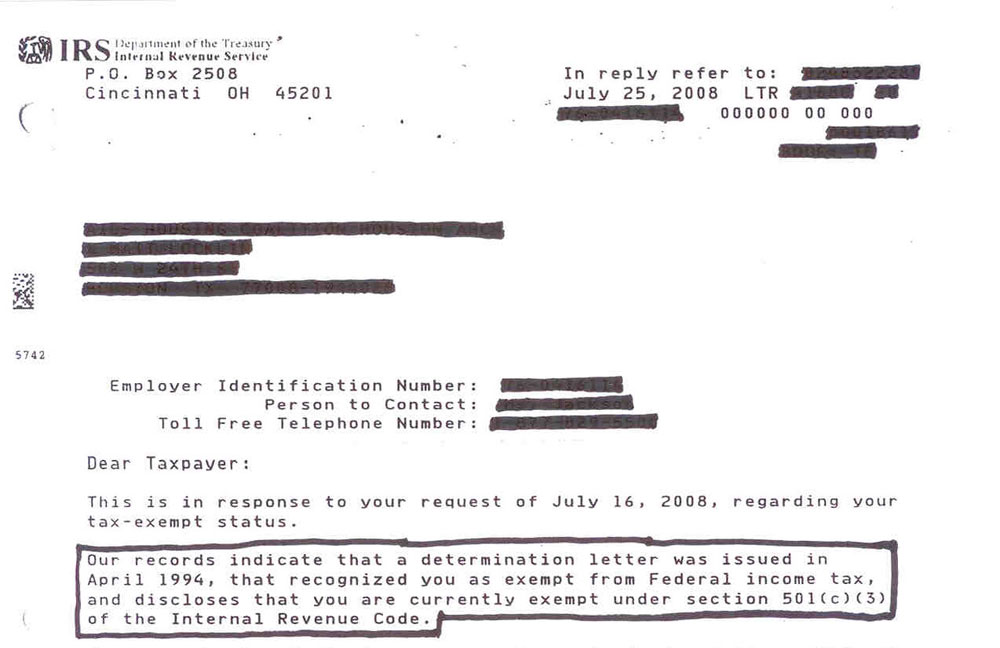

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Either the letter issued by the Department of Treasury prior to June 1994or. Only private qualified nonprofit housing that has received an exemption certificate from the Michigan Housing Development Authority MSHDA qualifies for this exemption.

This certificate is invalid unless all four sections are completed by the purchaser. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Commercial businesses in Michigan are tax-exempt for natural gas used in agricultural production.

Church Government Entity Nonprofit School or Nonprofit Hospital Circle type of organization. 06 Rental or leasing 15 Non-Profit501c3 501c4 or 501c19 07. Forms and instructions are available at the Attorney Generals website.

State income tax exemption. Community Consulting Associates specialized in helping nonprofit organizations with government reporting and tax requirements research and writing projects financial management media and government relations and issue development. 05 Government 14 Non-Profit Educational.

However if provided to the purchaser in electronic format a signature is not required. They are also exempt from sales tax on the Fixed Charge if they have no use. 06 Rental or leasing 15 Non-Profit 501c3 or 501c4 07 Retail 16 Qualified Data Center 08.

Sales Tax Exemption Certificate Validity Checklist. It is the Purchasers. Send a Michigan Sales Tax Certificate to Michigan Gas Utilities Customer Service PO.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. 501c3 organizations are automatically exempt from sales tax on purchases. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

RAB 2016-18 Sales and Use Tax in the Construction Industry. Charities may however need to present an exemption certificate in order to receive an. It is the Purchasers.

Most charitable nonprofits must also file with the Attorney Generals Charitable Trust Section. Michigan Department of Treasury Michigan. All fields must be.

Several examples of exemptions to the states. Michigan Sales Tax Exemption for a Nonprofit Michigan automatically exempts eligible charities from sales tax so there is no need to apply for an exemption. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

Call 517-335-7571 if you have questions or need forms. Your federal determination as a 501 c 3 or 501 c 4 organization. DO NOT send to the Department of Treasury.

Box 19001 Green Bay WI 54307-9001 or fax it to 800-305-9754. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. In the majority of states that have sales tax excluding Alaska Delaware Montana New Hampshire and Oregon the key to earning a sales tax exemption is being designated a charitable tax-exempt 501c3 nonprofit organization under the Internal Revenue Code.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. With the retirement of its founder Joseph S. TYPE OF PURCHASE One-time purchase.

State sales tax exemption. Michigan Department of Treasury Form 3372 Rev. Please refer to Revenue Administrative Bulletin 2016-18 which explains the exemption.

In order to claim exemption the nonprofit organization must provide the seller with both. For other types of tax-exempt nonprofits state. Any questions please contact the Michigan Department of Treasury Sales Use and Withholding Tax office 517-636-6925.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption. A Nonprofit Housing Entity qualified as exempt under the Sales and Use Tax Acts. To claim this exemption with each vendor submit a Certificate of Exemption form 3372 with a copy of the IRS 501c3 determination letter.

501c3 Tax Exemption is Key. For more information contact. Like Michigan exemptions offered to nonprofits for purchases of tangible personal property were expanded in 2013.

This page discusses various sales tax exemptions in Michigan. Any non-profit organization that is eligible to claim a federal exemption would use this form to claim an exemption from sales andor use taxes in Michigan. Owner president treasurer etc.

Sales Tax Update For Nonprofits

Costco Tax Exempt Fill Online Printable Fillable Blank Pdffiller

Where Can My Nonprofit Get Discounts And Tax Exemptions Charitable Allies

Start A Nonprofit In Michigan Fast Online Filings

Mi Dot 3372 2021 2022 Fill Out Tax Template Online Us Legal Forms

Most Youth Sports Organizations Don T Have 501 C 3 Tax Exempt Status

Not For Profit Vs For Profit Harbor Compliance Social Enterprise Business Benefit Corporation Social Entrepreneurship

How To Keep Your Michigan Nonprofit Compliant Truic

Sales Tax Exemption For Building Materials Used In State Construction Projects

Form 3520 Fillable Michigan Sales And Use Tax Contractor Eligibility Statement For Qualified Nonprofit Hospitals Nonprofit Housing Church Sanctuaries And Pollution Control Facilities Exemptions

Michigan Sales Tax Complexities For Nonprofits Yeo And Yeo

Michigan Sales And Use Tax Certificate Of Exemption

Reconsidering Charitable Tax Exemption A Modest Proposal For The Nonprofit 1000 Non Profit News Nonprofit Quarterly